Carte France - 650 sites transfo - ANG

Everything you need to know about milk and dairy products, the different steps involved in processing them, their diversity and health benefits. Also, practical information such as how to read food labels, make homemade dairy products,…Dairy Products website

Everything you need to know about milk and dairy products, the different steps involved in processing them, their diversity and health benefits. Also, practical information such as how to read food labels, make homemade dairy products,…Dairy Products website

All about how CNIEL serves the French dairy industry. The organization addresses a wide range of issues, from the dairy economy, international business and promotion, to technology and scientific research. Its work is aimed at helping dairy producers and processors to anticipate market developments and build a strong future.Cniel Infos website

All about how CNIEL serves the French dairy industry. The organization addresses a wide range of issues, from the dairy economy, international business and promotion, to technology and scientific research. Its work is aimed at helping dairy producers and processors to anticipate market developments and build a strong future.Cniel Infos website

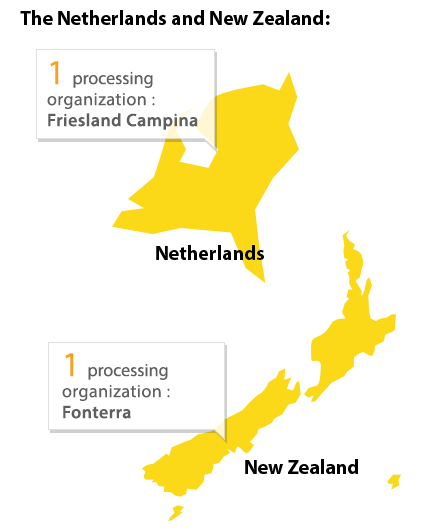

The French dairy manufacturing model is both unique and effective, featuring a wide diversity of stakeholders and products. This diversity brings a certain balance to rural France and French trade.

What is a dairy cooperative?

A dairy cooperative is a collective enterprise created by dairy farmers pooling their financial and material resources to develop their farms, process milk and sell it in the long term.

Based on the values of solidarity, fairness and responsibility, a cooperative can range in size from an SME to a multinational.

Examples of French cooperative brands include Cœur de Lion, Candia, Entremont, Le Rustique, Mamie Nova, Soignon and Yoplait.

What are the differences between cooperatives and private companies?

The main difference concerns ownership. In cooperatives, the owners are the dairy farmers themselves (cooperative members), whereas in private companies, the owners are the shareholders.

Cooperatives process all the milk provided by their members. Meanwhile, private companies develop agreements with farmers on the volumes purchased.

Key figures

Private processors

Dairy cooperatives

Find out more...

Farmhouse cheese producers are small, local cheese-making cooperatives.

First appearing in the 13th century in certain villages of the Alps and the Jura region, these producers are now mainly found in Franche-Comté and Savoy. Around 200 of them exist today, focusing their business mainly on transforming milk into Protected Designation of Origin (Appelation d’Origine Côntrolée) cheese.

Firmly rooted in their local areas, farmhouse cheese producers help to preserve the diversity of French dairy products and skills. In 2012, for example, makers of Comté cheese exported 3,940 tonnes of cheese, or 7% of their total production.

French dairy SMEs have often been born from a family’s desire to maintain an ancestral tradition. There are currently about 370 of them spread out across France, serving regional or national markets.

Faced with increasing competition from large European or even global groups, these SMEs are increasingly joining forces to improve their performance while aiming to preserve the differentiating features of their products.

Some French groups created at the end of the 19th century to meet increasing demand in towns and cities have adapted to globalization.

Five French groups are listed in the global top 25.

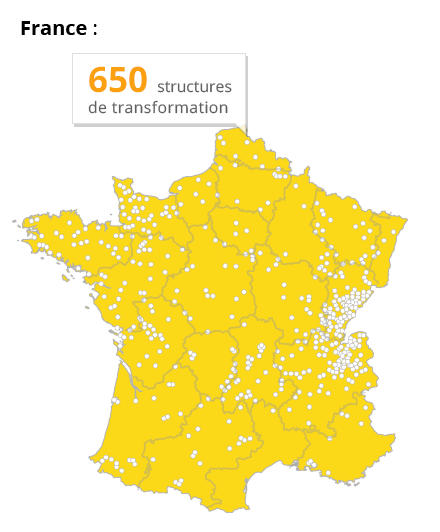

650 processing plants and 56,500 jobs

The majority of processing plants are located in rural areas in close proximity to production sites for logistical reasons. As a fragile raw material, milk must be transported from the farm to the dairy within 72 hours at a reasonable cost, in terms of both finance and the environment.

Dairies therefore play a key role in supporting the rural economy and preserving jobs. Theirs is a long-term business, given the difficulty of relocating dairy farms with the meadows and crops that provide most of dairy cattle’s feed.

The partnership created many years ago with the six ENILs (National Dairy Industry Schools run by the French Ministry of Agriculture) is a key contributor to the dairy industry’s dynamic vocational training. Focused above all on initial training, these schools play an essential role in passing on key skills, especially through apprenticeships. This is a feature of the university diploma in Dairy Products, which was set up at the industry’s request.

Des savoir-faire historiques en région

La carte de France des produits laitiers AOP

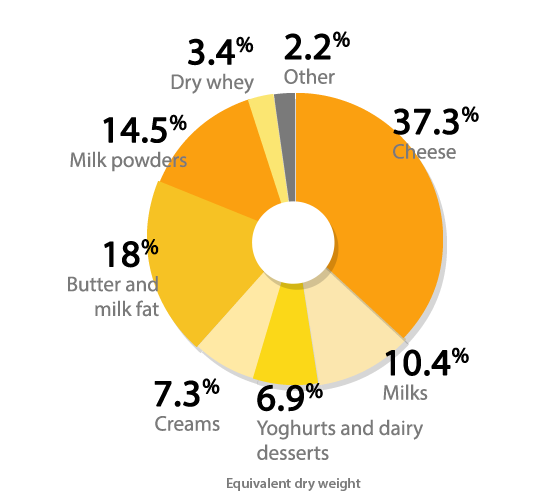

75% of collected milk is transformed into consumer products

(cheese, yoghurts and cream, including 49 PDO products)

25% of milk is transformed into industrial ingredients

(lactoserum power, concentrated butter, etc.)

N°1

2014 revenues: $21.9 billion

N°1 worldwide for milk, n°2 worldwide for cheese

Leading brands: Lactel Eveil, Président, Société, Galbani, etc.

N°6

2014 revenues: $14.8 billion

N°1 worldwide for fresh dairy products and n°4 worldwide for milk

Leading brands: Gervais, Danette, Taillefine, Activia, etc.

N°12

2014 revenues: $7,2 billion

N°2 worldwide for fresh dairy products

Leading brands: Candia, Grand Lait, Viva, Croissance, etc.

N°14

2014 revenues: $6.1 billion

N°1 wordwide for cheese spécialties

Leading brands: Tartare, Saint-Morêt, Caprice des Dieux, Elle&Vire, etc.

N°25

2014 revenues: $3.7 billion

Leading brands: Kiri, Vache Qui Rit, Boursin, Apéricube, etc.