Export figures

- 4 out of very 10 litres of milk are exported

- €6.6 billion of French dairy products exported (2016)

- €3.4 billion trade surplus (2016)

+ 71% in 10 years

Everything you need to know about milk and dairy products, the different steps involved in processing them, their diversity and health benefits. Also, practical information such as how to read food labels, make homemade dairy products,…Dairy Products website

Everything you need to know about milk and dairy products, the different steps involved in processing them, their diversity and health benefits. Also, practical information such as how to read food labels, make homemade dairy products,…Dairy Products website

All about how CNIEL serves the French dairy industry. The organization addresses a wide range of issues, from the dairy economy, international business and promotion, to technology and scientific research. Its work is aimed at helping dairy producers and processors to anticipate market developments and build a strong future.Cniel Infos website

All about how CNIEL serves the French dairy industry. The organization addresses a wide range of issues, from the dairy economy, international business and promotion, to technology and scientific research. Its work is aimed at helping dairy producers and processors to anticipate market developments and build a strong future.Cniel Infos website

French dairy products are export champions! Four out of every 10 litres of milk are exported and the industry’s trade surplus reached €3.4 billion in 2016. This strong export business is supported by a favourable national and international context.

+ 71% in 10 years

Who around the world has not heard of France, the country of 1,000 cheeses? The reputation that French dairy products enjoy abroad is the result of the industry’s ongoing investment in quality, food safety and communication.

French quality

For dairy products, “Made in France” is a guarantee of quality, taste and sophistication.

This excellent reputation results from ongoing efforts by the entire industry to guarantee quality at every step of the value chain, through good agricultural practices, milk controls and analyses, R&D, quality management, and so on.

French excellence in food safety

France sets an example in the face of food scandals, like the case of melamine in milk in China. As demonstrated in the production of raw-milk products, the French dairy industry has developed rigorous expertise in managing food safety risks and providing consumers with healthy, safe and good dairy products.

The positive image of dairy products maintained by communication

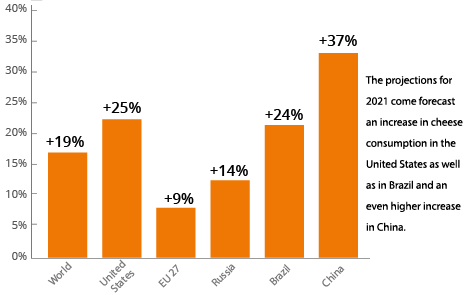

The global dairy market is highly competitive, so the French industry must communicate to promote its products and develop new uses. This is exactly what it has been doing since 2007 through communication campaigns targeted at countries with a double-digit consumption growth: firstly, in rich countries such as the United States, Japan, and Korea, and secondly in those that have come to be known as the BRIC countries (Brazil, Russia, India and China).

These campaigns build on the traditional messages of expertise, quality and so on, but also on the concept of making something one’s own. In Kyoto, Japan, 1000 people were able to take part in a tasting session which combined cheese and tea in a Zen temple.

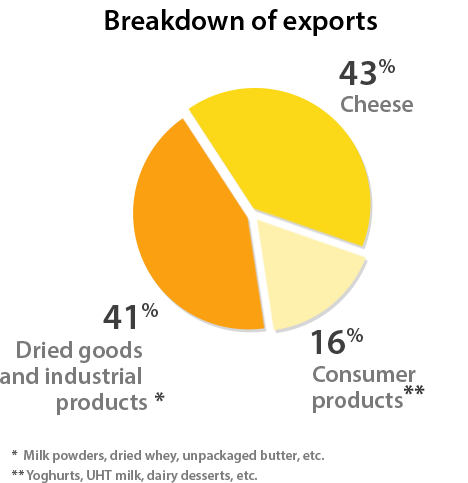

The most exported French dairy product is cheese, which represents 44% of all French dairy exports.

Cheese is the perfect example of a value-added product as the dairy category that makes the most profit, propelling France to the rank of Europe’s third-largest cheese exporter in terms of value and first in exports of soft cheese and Emmental. But France also exports to countries further afield where the reputation of French cheese precedes it; e.g. in Russia, China and Japan.

Milk powder: a new white gold?

The global market for milk powder is fast expanding. Some 56% of milk powder produced in France is exported, mainly to the European Union, Asia and the Middle East.

Camembert de Normandie (Normandy Camembert) an icon of French gastronomy, requires considerable expertise and a maturing period of at least 21 days – much longer than industrial cheese..

There are more than 1,500 varieties of dairy products, including 1,200 varieties of cheese!

This wide range of products enables French dairy exporters to cover every market segment:

Five French dairy groups appear in the global top 25 dairy exporters! Firmly established on the five continents, they have longstanding experience in foreign markets and enable France to shine in terms of exports.

2014 revenues: $21.9 billion

N°1 at a global scale for milk

2014 revenues: $14.8 billion

N°1 at a flobal scale for fresh dairy products

2014 revenues: $7.2 billion

N°2 at a global scale for freh dairy products

2014 revenues : $6.1 billion

N°1 at a global scale for cheese specialities

2014 revenues: $3.7 billion

Products sold in more than 120 countries

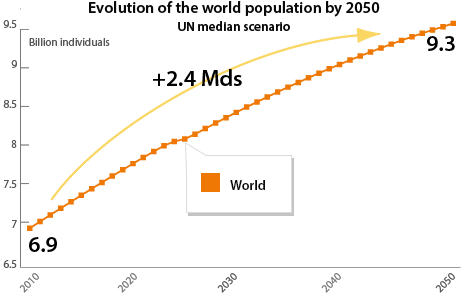

A market driven by strong population growth worldwide

From 1990 to 2020 the global population will grow on average by 80 million people every year. Starting in 2020, demographers predict growth of 50 million inhabitants per year, bringing the global population to 9 billion by 2050!

Africa and Asia largely have a shortage of dairy products. These countries also suffer from limited access to water and land, which are critical for dairy production. This is an opportunity for the French dairy industry.

Emerging countries: development of a middle class that consumes dairy products

Between 2000 and 2050, consumption of dairy products is expected to double:

- An increase in 45 to 78 kg per inhabitant per year

- Or +1.8% per year on average globally, compared to 0.2 per %year in developed countries, which are mature markets

In 2050, emerging countries will account for two-thirds of dairy product consumption.

This will represent 680 million tonnes, compared to 370 million in developed countries.

France is well positioned on growth segments: industrial products and cheeses.

Cheese already represents 43% of French dairy exports, while industrial products such as milk powders represent 41%.

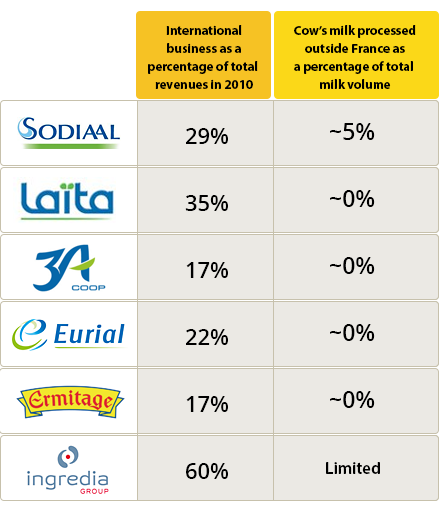

Some companies, mostly cooperatives, approach international markets with an export and/or partnership strategy.

They made products in France and expand their businesses abroad by developing distribution agreements with local partners to reinforce their position on their markets.

Other companies maintain a major export business while expanding abroad through an international presence, in particular by acquiring local companies.

In this way, they achieve a significant share of their revenues abroad. For example, Lactalis generates 70% of its revenues outside France.

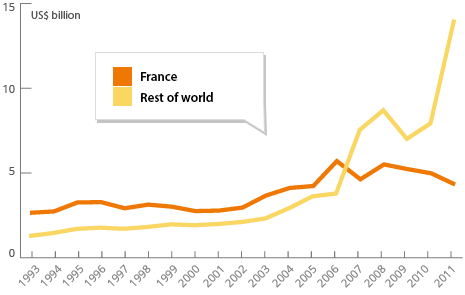

Evolution of Lactalis revenues abroad

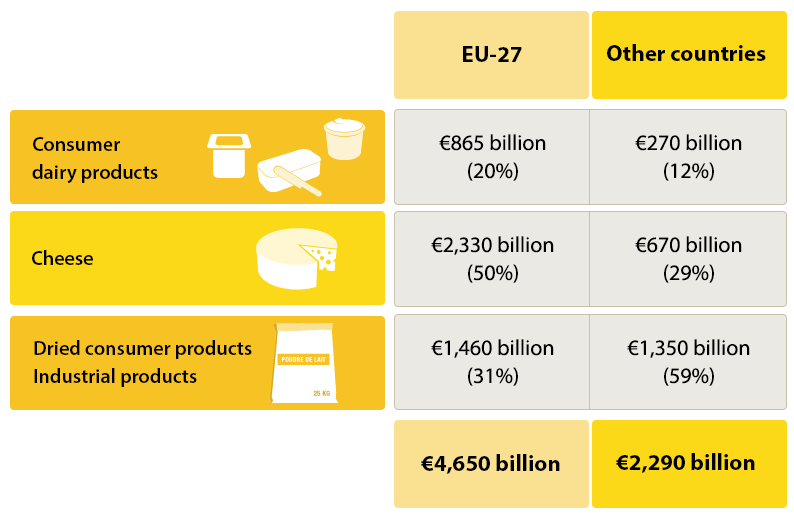

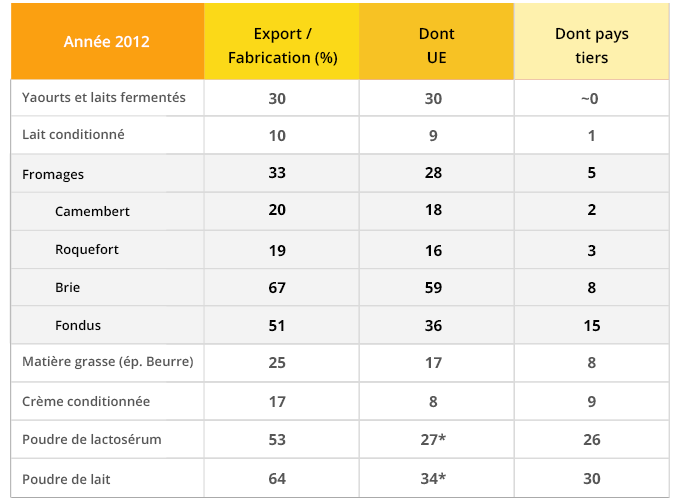

Companies export different product ranges within or outside the European Union depending on their existing partnerships and consumers’ habits and disposable income in each country, as well as product shelf-life, legislation, etc.

Companies therefore tend to export more cheese and fresh products (consumer dairy products) within the European Union, where it is easier to transport perishable products and where the standard of living is relatively high.

Conversely, milk and lactoserum powders (dry products that are easy to transport), are exported to countries further afield, such as China. This country also offers interesting opportunities on the powdered baby milk market.

Breakdown of exports by geographical zone and by product

Breakdown of revenue by dairy product